Centuria Office REIT (ASX:COF) offers investors a chance to invest in commercial property via a real estate investment trust (listed property trust). COF is Australia’s largest pure play office REIT (A-REIT) and is included in the S&P/ASX300 Index. COF has a geographically diversified portfolio of 22 high quality assets with a value of $2.1 billion*. The portfolio is predominantly exposed to metropolitan and near city office markets that are well connected to transport and lend themselves to affordable rents.

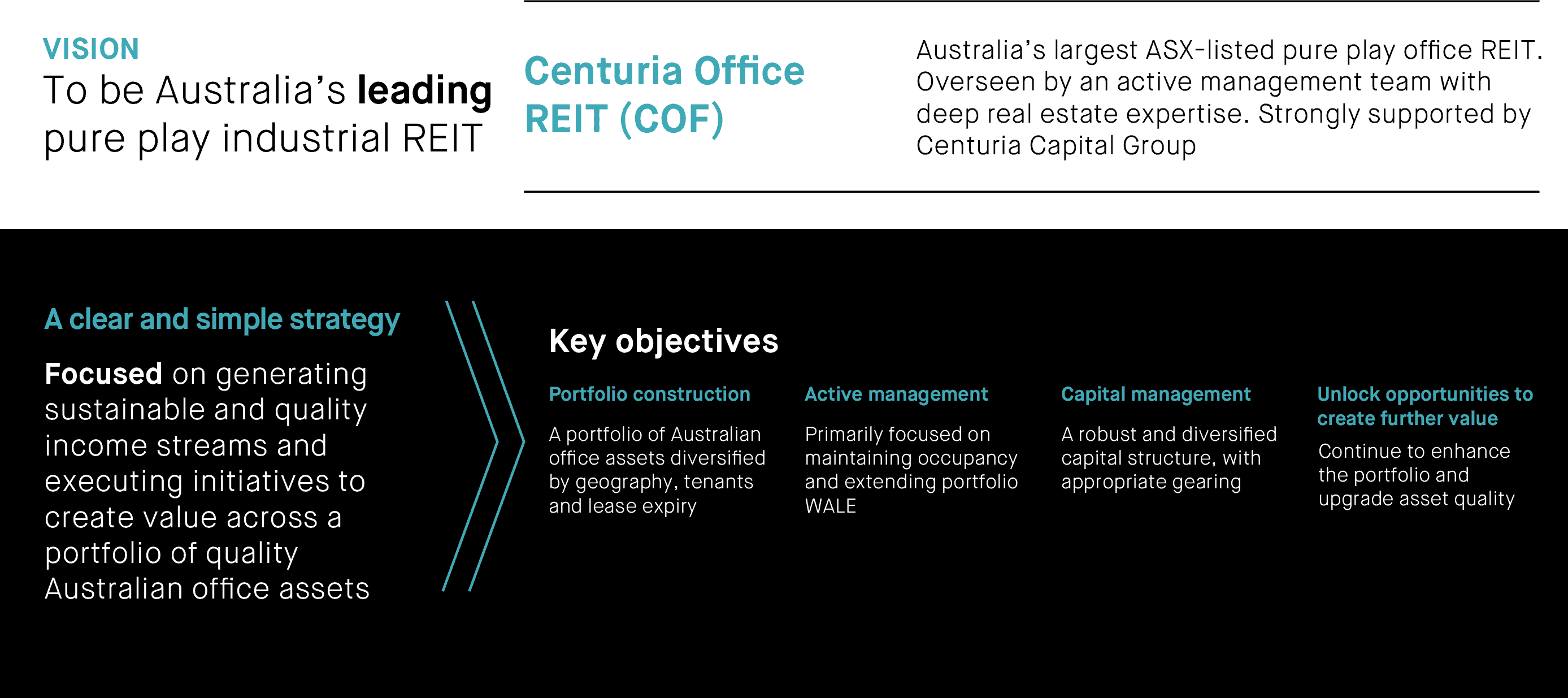

COF investment objectives

The primary objective for COF as a real estate investment trust is to generate sustainable and quality income streams, by executing initiatives to create value across a portfolio of quality Australian office assets.

COF has a young portfolio with the average age of buildings being approximately 17 years old. It benefits from a strong tenant profile, and 90% of its buildings are A-Grade assets.

* As at 31 December 2023